- #National flood insurance program maximum coverage how to#

- #National flood insurance program maximum coverage full#

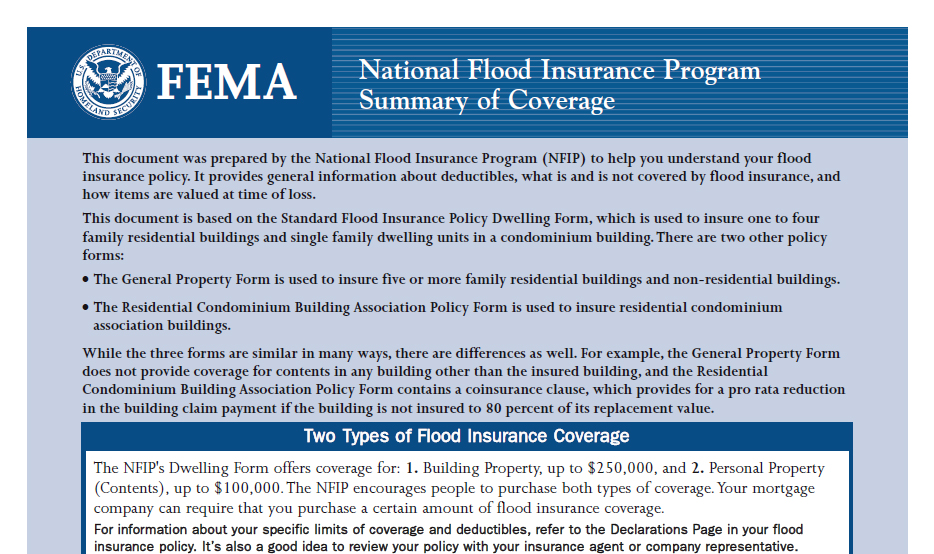

When Should Flood Insurance be Purchased? The maximum coverage a business can get is $500,000 in building coverage and $100,000 in contents coverage. The maximum coverage, though the NFIP, for residential structures is $250,000 in building coverage and $100,000 in contents coverage. Additionally, one-third of all federal disaster assistance for flooding has been paid to properties in low to moderate-risk areas. Over 20 percent of all flood insurance claims filed through the National Flood Insurance Program (NFIP) come from structures located outside high-risk areas. For properties in Flood Zone X, (low to moderate risk areas), flood insurance is still highly recommended. Properties in Flood Zone AE and VE (high-risk areas) are required to carry flood insurance if they have a federally backed mortgage. The cost of flood insurance varies depending on how much insurance is purchased, what’s covered, and the property's flood risk.įlood Insurance Requirements and Benefits All policy types provide coverage for buildings and contents. Neither homeowner’s nor rental insurance covers property or content damage resulting from a flood event.

To protect these investments, flood insurance is available to homeowners, renters, and commercial owners/renters. Geographically, our low-lying communities are at or below sea level, which increases the vulnerability of our structures to flooding from hurricanes and/or heavy rainfall events. ICC claims will only be paid on flood-damaged homes and businesses, and can only be used to pay for costs of meeting the floodplain management ordinance in your community.Flood insurance is a wise investment for all residents and property owners in Jefferson Parish.

#National flood insurance program maximum coverage full#

Once you submit this document to your claims representative, your insurer will pay the final installment or full payment. When the work is completed, local officials will inspect and issue a certificate of occupancy or a confirmation letter. If the work is not completed, you must return any partial payment to your insurer. You may be able to receive a partial advance payment for up to half of the eligible benefit or up to $15,000 once the claims representative has a copy of the signed contract for the work, a permit from the community to do the work, and a return of your signed ICC Proof of Loss. You should start getting estimates from contractors to take the necessary steps to elevate, relocate, floodproof, or demolish. Your insurer will assign a claims representative who will help you process your ICC claim. Once your community has made this determination, contact the insurance company or agent who wrote your flood policy to file an ICC claim. You may also want to consult with the local official before you make the final decision about which of the options to pursue. If your community does determine that your home or business is substantially or repetitively damaged, a local official will explain the floodplain management ordinance provisions that you will have to meet. This determination is made when you apply for a building permit to begin repairing your home or business. You can only file an ICC claim if your community determines that your home or business has been substantially damaged or repetitively damaged by a flood. Your ICC claim is adjusted separately from the flood damage claim you file under your Standard Flood Insurance Policy.

#National flood insurance program maximum coverage how to#

How to File an Increased Cost of Compliance Claim Additionally, there must have been flood insurance claim payments for each of the two flood losses.

If your community determines that your home or business is damaged by flood to the point that repairs will cost 50 percent or more of the building's pre-damage market value.Below are the definitions to learn more about those terms: If you receive a declaration from your local floodplain administrator that your home is substantially or repetititvely damaged, you may file a claim for your Increased Cost of Compliance (ICC)coverage. When to File an Increased Cost of Compliance Claim

It involves making a building watertight through a combination of adjustments or additions of features to the building that reduces the potential for flood damage. This option is available primarily for non-residential buildings. This moves your home or business out of harm's way.

0 kommentar(er)

0 kommentar(er)